Introduction: from responsibility to impact

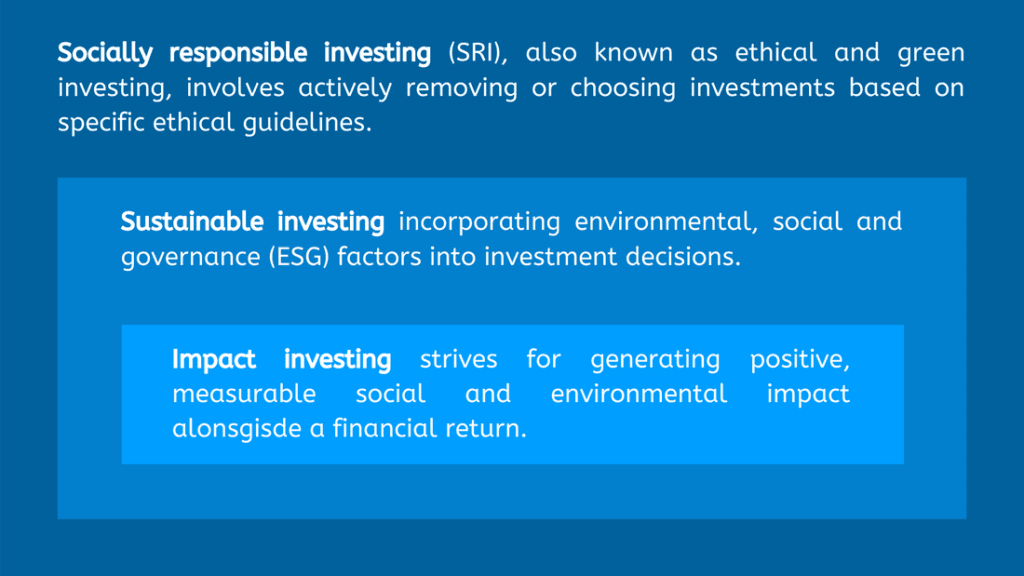

Impact investing goes one step beyond responsible investing. It is by definition investing into generating positive, measurable social and environmental impact alongside a financial return. With more and more PE funds and VCs setting out an impact thesis, adopting an impact measurement framework from early on makes a startup well-positioned for communicating with investors in the future.

Responsible investing = incorporating Environmental, Social, and Governance (ESG) factors into investment decisions.

How to measure? UN Global Compact Assessment Tool

Test your company’s performance on all ten UN Global Compact principles and how well these issues are managed. The tool is based on international standards and best practices. Designed for use by all company sizes and sectors in all countries.

Open the UN Global Compact Assessment Tool.

Impact investing = generating positive, measurable social and environmental impact.

How to measure? Startup Impact Measurement Guideline by FiBAN

The Startup Impact Measurement Guideline is a practical, from-angels-to-angels guideline to help impact startups setting up practices on how to define their impact, measure it, and constantly develop it. By adopting an impact measurement framework as described in the guideline, a startup is well-positioned for communicating with investors and ensuring the fit to the investment thesis of investors following UN’s Impact Standards for Private Equity Funds.

A guide for more impact conscious investments

Framework for Impact Investing

How to define impact investing?

Impact investing strives for generating positive, measurable social and environmental impact alongside a financial return. Positive outcomes are of the utmost importance, and impact investments are made with the intention of accomplishing specific goals that are beneficial for the sustainable development of the world.

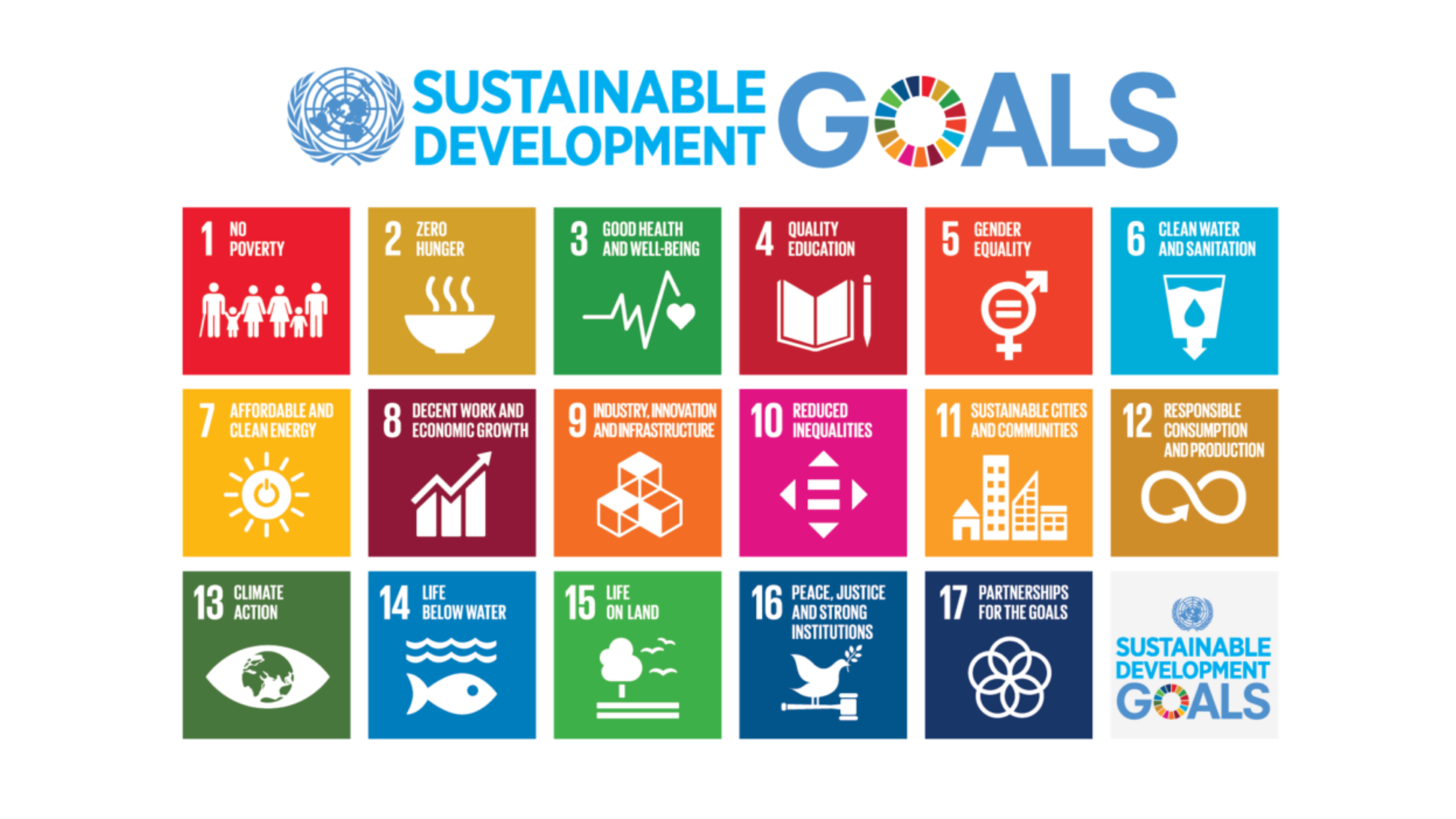

World’s to-do list: Sustainable Development Goals

Impact investing is often connected to the United Nations’ 17 Sustainable Development Goals (SDGs) and their sub-targets of the 2030 Agenda for Sustainable Development. The 17 SDGs, 169 sub-targets, and 232 unique indicators are a to-do list for people and the planet. For an investor, the SDGs offer a tool to define a problem and a need that is widely recognized.

SDG-Tracker.org presents data across all available indicators from the Our World in Data database and tracks global progress towards the SDGs.

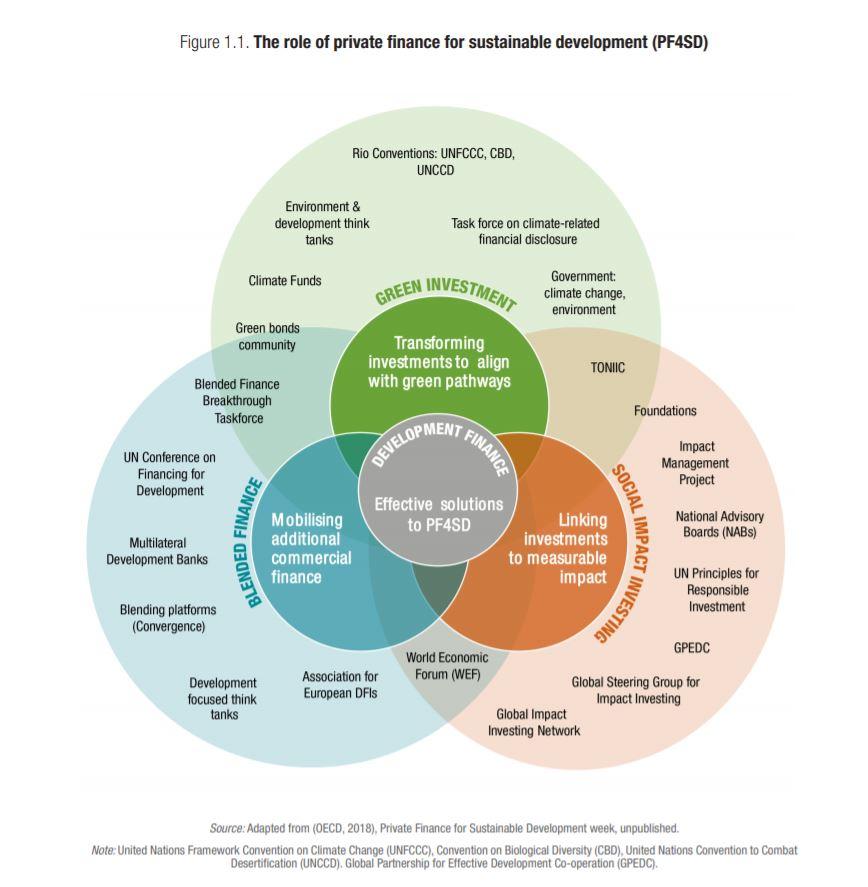

Mapping the role of Private Finance for Sustainable Development

Investing in agile impact startups is an efficient way to have an influence on what the future will look like. Today’s small startup company can make a big impact tomorrow.

The OECD has formed a set of effective approaches and tools to leverage Private Finance for Sustainable Development (PF4SD). They describe the set in three categories: social impact investing that links investments to measurable investments, blended finance that mobilizes additional commercial finance, and green investment that transforms investments to align with green pathways. All three financing approaches can help address the financing gap for the SDGs and redirect private finance for Sustainable Development (Figure 1.1).

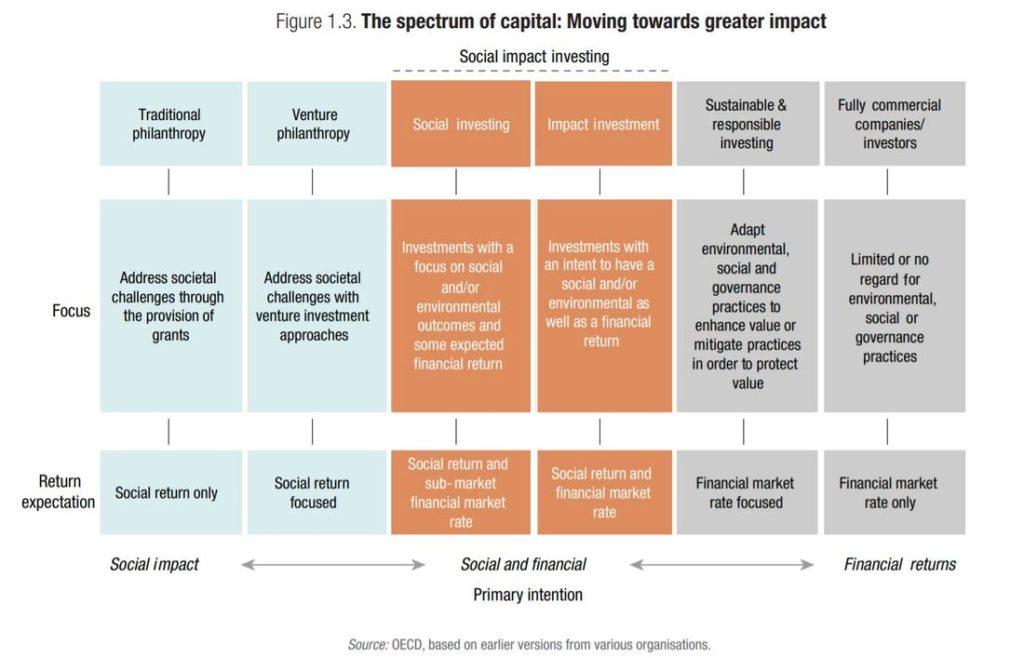

Investments can no longer be valued only in financial returns and we are moving towards greater impact. A growing number of private sector actors are focusing on investing for specific social, environmental, or economic outcomes, including those outlined in the SDG’s, states OECD’s report. It’s estimated that USD 22.89 trillion of assets were under sustainable investment strategies in 2016.

OECD’s figure of the the spectrum of capital shows the balance between the target of social impact and financial return (Figure 1.3).

Angel Perspective

Impact investing is close to many FiBAN members’ hearts. We have picked you some of FiBAN’s news articles and interviews related to impact investing. Take a closer look at the tips and advice from impact investing experts.

Define and evaluate

There are various ways to define, specify and evaluate impact investing. However, there is neither one comprehensive way of measuring the impact of an investment nor a policy for reporting impact. Here we have collected some best practices, tools, and worksheets used in the industry that we see helpful in the process of evaluating, measuring, and managing impact.

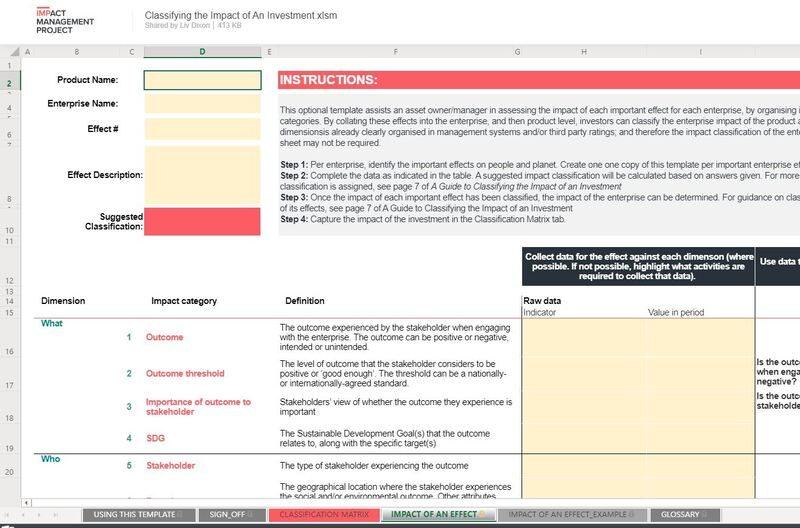

Impact data categories template helps measure impact in practice. IMP has broken the five impact dimensions down into 15 categories of data that investors can collect into a pragmatic Excel sheet.

Widen your knowledge and take a deep dive into the impact investing scene.

Here are some publicly available reports and studies, and other open-source material from relevant organizations.

Develop the Toolbox with us

We want to collect concrete tools to help business angels make impact-conscious decisions and to have follow-up reporting tools to keep good impact work going. Therefore, we are constantly gathering more experiences about impact investing from angel investors’ perspectives.

If you are passionate about the topic, please share us your ideas and best practices with us so that we can spread the word to the angel community. After all, we all have the common mission of making the world a better place.

Comments are closed.