In this interview, we’ll get to know one of our new partners, Baltic Sandbox Ventures: a deep tech fund operating in the Baltics and Nordics with a focus on early-stage, science, and advanced engineering R&D-based ventures built by teams solving complex, worthwhile problems.

From fintech to research and beyond

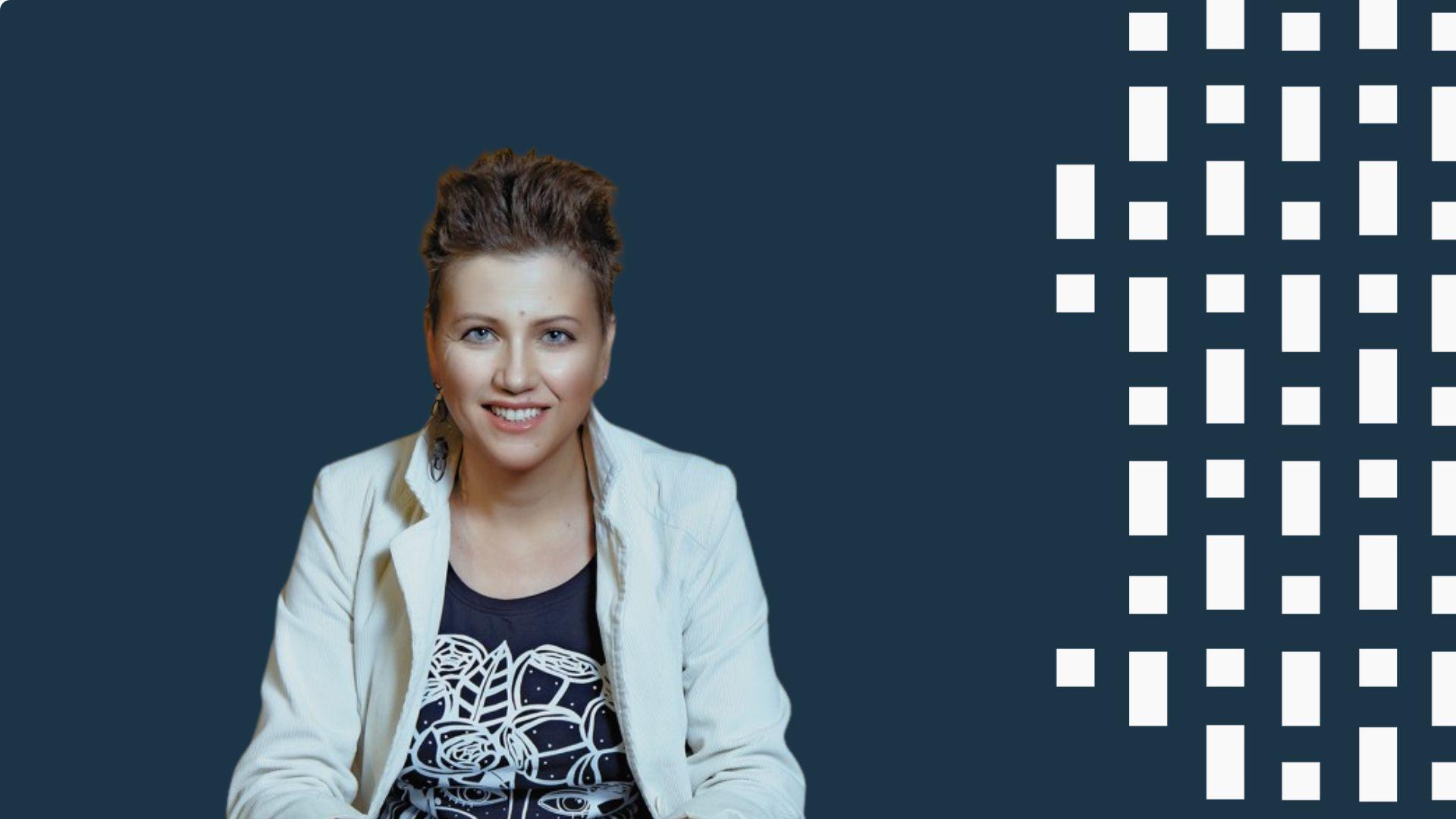

Baltic Sandbox first started as an accelerator in 2018, and ever since, they’ve gotten to know all sides of the coin of startups. “Originally, as deep tech startup founders, we’ve been through the whole journey, and it has given us perspective: as founders who exited, to building and running the accelerator before launching this VC fund. We know the pains and challenges of deep tech startups,” Sandra Golbreich, co-founder of Baltic Sandbox Ventures, says. Join the Deep Tech Investor Day on May 29 to meet the team.

Baltic Sandbox was one of the first accelerators in the Baltics to focus particularly on deep tech, and they quickly noticed where founders needed the most meaningful support.

“Since our 2018 accelerator program launch, we saw some huge gaps in the existing accelerators, such as how the accelerators approach the topics of financing and business models. There was a lot of emphasis on pitching and presenting, but very little on the real core of what makes a business work. More detailed help was needed, as good financial strategy and management is one of the most vital topics for startups – especially when resources are tight.”

The General Partners of Baltic Sandbox Ventures, Sandra, Erik, and Andrius, noticed a gap in the market for a true early-stage deep tech VC and decided to work with startups and research projects at the very early stages. They helped entrepreneurs and researchers focus on their strengths from day one.

“No one in the region is going in as early as we do with the first investments and support of the founders with the acceleration program. A huge part of our program is developed around the idea that we are not trying to turn scientists into business managers or CEOs. But in some cases, when they are CEOs, we help them build the support structure around themselves by selecting the right team,” Golbreich describes.

Co-investing with angel investors: expertise and networks

For Gobreich, co-investing with angels is a common practice. Baltic Sandbox Ventures actively co-invests into startups together with cross-border angel syndicates. In fact, half of their seed fund capital also comes from angels.

“According to our data, the total size of our co-investments during the last year of operations is over 7.5 million, and millions of that come from angels who like to invest alongside us. We’re used to working with angels, and it’s beneficial because angels are active, bring expertise, network, and literally support the startups. All of our best investments were made together with actively participating angels,” she says.

Leveraging Science with IP Investments

Baltic Sandbox Ventures’ approach to co-investing involves not only supporting a startup but also recognizing the value of research itself. “All of our investments are in companies that leverage science. Those companies have intellectual property that has value in itself. Even if the startup doesn’t enter the market, there’s still a possibility of exit because the IP can still be sold. When we look at risks, these are less risky investments than generalist investments. With life sciences, medicine, and deep tech, the risk is smaller, as these industries are less prone to financial or other societal crises, for example.”

However, in deep tech, IP needs to be protected properly: global patenting plays a huge role, and Golbreich strongly recommends international patents to startup founders in deep tech.

“Patents are very serious for deep tech. The IP should belong to the startup entity, and founders must make sure to get into an agreement with the university about the IP transfer and make sure that the IP is adequately protected and transferred to the company. Patenting in the right manner is critical: seek competent advice not only from a patent attorney but also from litigators with experience defending or building cases based on patents. And make sure never to miss your next filing deadlines, for example,” Golbreich says.

Benefits of co-investing: due diligence and understanding science

As many angel investors know, deep tech is becoming more popular. Baltic Sandbox Ventures’ Partners have been pioneering in this area and believe that having an edge based on technology (and properly protected IP) makes science-backed startups more resilient and increases the odds of success as they enter the market. However, science-backed startups require specialized expertise, and investing requires several angels to join and coordinate the due diligence process. Co-investing with operators such as Baltic Sandbox can be a good way to start, as they have a specialized team for due diligence.

“For example, we invest in startups focused on deep tech domains such as quantum computing, space tech, dual-use, AI, and more. One example is a startup that develops unique motion capture sensors that can be used in rehabilitation, combat sports, or even military training to improve safety measures. This kind of tech can be applied to different verticals. Some of our recent investments include Black Swan, which was just announced, and more will be announced soon. There’s even a startup reinventing helicopters,” she describes.

“We perform tech due diligence extensively with scientists and institutions from different industries. It’s also important to be able to evaluate a business without creating a situation where the startup risks exposure of intellectual property, because that may cause issues defending IP later on. By outsourcing it to trusted, vetted experts who evaluate it under NDA, they know how to write us reports without exposure to the IP, focusing on validating key parts important for our analysis. Angels can also send startups our way to ask our opinion on them, and we are happy to share the due diligence summary. This part of the work is expensive and time-consuming, and angels often don’t have the resources or network to do it; this is one of the many areas where we can help,” Galbraith says.

Interested in deep-tech and co-investing?

Want to learn more about deep tech investing? Join the Deep Tech Investor Day on May 29, or contact Walid El Cheikh or Sandra Golbreich.

Want to be featured here?

Join as a FiBAN partner.

Already a Partner and got a story to share?

Contact FiBAN’s Communications Manager at milja.makela@fiban.org