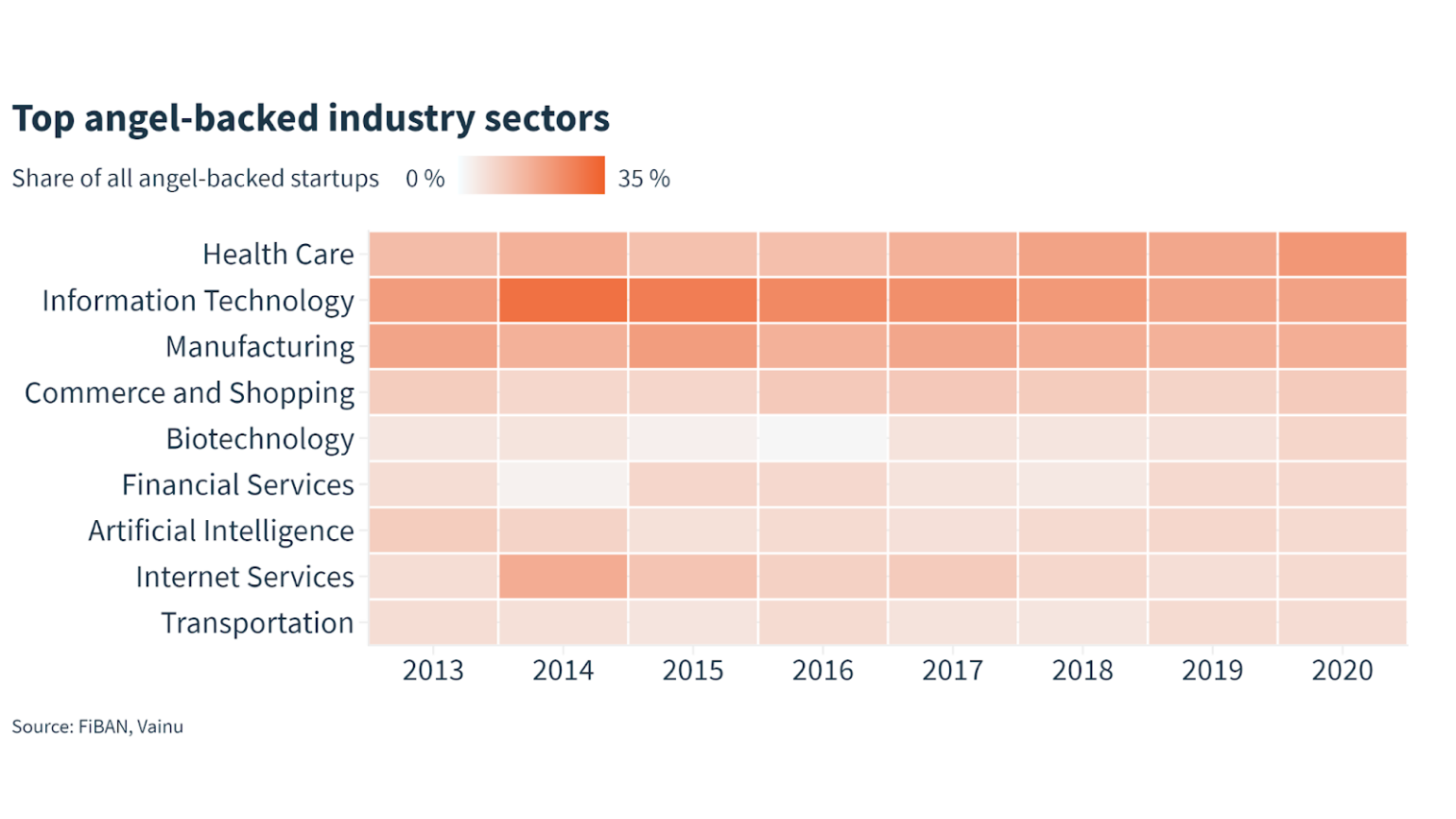

The most popular sectors for business angels in Finland are healthcare, information technology, and manufacturing. The interest in healthcare among business angels has been increasing steadily in the past years, up from 13,3 percent of all startups funded in 2015 to 22 percent in 2020. The pandemic also boosted the valuation of healthcare startups in Finland, almost doubling from 2019 to 2020. In contrast, the median valuation of all angel-backed companies slightly decreased.

Among companies that have received business angel funding, the fastest growing sector is biotechnology, which accounted for 9 percent in 2020. This interest is likely to continue given the boost of the pandemic. Edtech is another interesting sector that has seen an increase in popularity in the last three years, quadrupling in 2020 compared to the average 2013-2017.

Scalable technology at the core of many startups

Scalable technology is at the core of many fast-growing startups: almost a third of all angel-funded startups are focusing on software products. In 2020, 8 % of all startups that received angel funding deployed some form of artificial intelligence or advanced analytics as part of their core business. Companies in the IT sector use most AI, followed by internet services and healthcare.

“As progress is constant, so is the speed at which industry sectors backed by angels change as well. Also, interesting to note, how many of the sectors which are trending now, or beginning to bubble under, didn’t even exist a decade ago”, notes Amel Gaily, Managing Director of FiBAN.

Investing in early-stage startups are high-risk investments. This study shows that of all startups funded by business angels 2013-2016, 32 % have either discontinued their business or are operating without webpages. This rate is highest among startups in the finance and insurance business (50 %).

A novel algorithm behind the new data

The study uses a novel industry classification algorithm developed by Vainu that automatically categorizes startups based on their webpage and improves understanding especially of new businesses significantly better than the TOL-classification system.

“A more accurate understanding of the evolution of industry verticals from an early stage helps stakeholders understand the dynamic changes taking place in the market. FiBAN’s investments in data and research are an excellent example of a collaboration that allows us to work together to understand the evolution of new phenomena in the wider startup ecosystem and, accordingly, share it with a broader audience in the venture capital field. Vainu’s classification method is a pioneer also on the international level and succeeds in creating a consistent and objective vertical classification for the entire company landscape”, comments Henri Hakamo, Chief Digital Officer at Tesi.

Additional information:

FiBAN

Amel Gaily, +358 50 3655 019, amel.gaily@fiban.org

Tesi

Henri Hakamo, +358 40 050 2721, henri.hakamo@tesi.fi