FiBAN has published the annual angel investing statistics in Finland. In total, business angels invested 54 million euros into 415 startups during 2019. Read a summary of FiBAN’s statistics and comments on the current market situation of angel investing.

[Lue suomeksi – in Finnish]

Finnish Business angel investments reached an all-time high in 2019, with 54 million euros invested into 415 startups. The statistics were collected from FiBAN members in the association’s annual investment survey. FiBAN has collected the statistics since 2011 and they are among the largest and most comprehensive studies regarding angel investing gathered in Europe.

One of the explanations behind the record figures is that in 2019 there were a few exceptionally large investments done. “Our community of over 650 angel investors consists of investors with different kinds of profiles. As angel investors invest their own capital, there is a lot of variation in the size of the investments, and some of our members invest very large tickets,” explains Amel Gaily, FiBAN’s Managing Director. In 2019 there was an exceptional amount of follow-on investments, which is typical for angel investors.

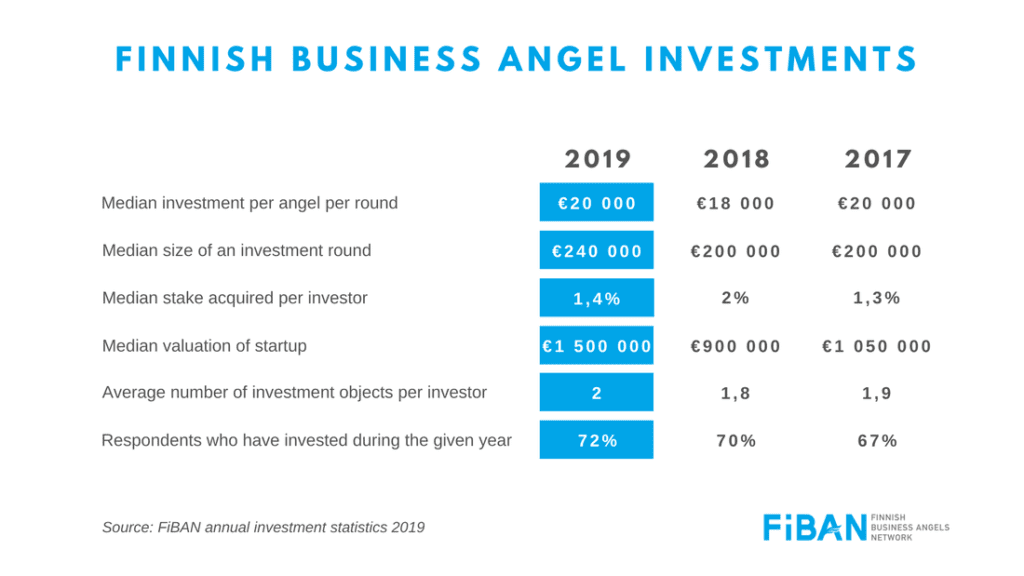

”As opposed to a single year, it is essential to focus on the long-term trend,” Gaily emphasizes. The median statistics did not change relatively much compared to the previous years: the median investment ticket per angel per round was 20 000 euros and the median size of an investment round was 240 000 euros.

On average, a FiBAN member made two new investments during 2019, most of which were made as syndicates together with other investors. FiBAN members have a total of more than two thousand portfolio companies in their investment portfolios.

“In addition, our members invest a significant amount of time and expertise in startups, the value of which cannot be measured in money,” Gaily emphasizes. The experience, networks, and support shared by business angels are an important resource, especially for early-stage companies that grow with scarce resources.

Impact of the corona crisis on new investments – main focus on own portfolio companies and the well-being of entrepreneurs

The corona crisis has shaken markets and driven the economy to uncertainty. “The current market situation will also affect angel investments. The expectation is that investors will focus much of their attention on the future funding rounds of their portfolio companies. However, good companies will still find financing, provided the conditions are right,” estimates Reima Linnanvirta, Chair of the Board of FiBAN.

According to Linnanvirta, the share of future funding rounds is likely to increase this year as investors help their portfolio companies during exceptional times. As is customary in angel investing, help for entrepreneurs doesn’t just come in the form of money. Angel investors are currently working hard together with their portfolio companies to ensure business continuity in a challenging situation.

Especially important is to take care of the well-being of the entrepreneurs, as well as mental support. In late 2019, FiBAN took as it’s special theme to promote everyday communication and an open atmosphere between investors and startup entrepreneurs. The #WhatsUpFounder campaign, launched on Valentine’s Day, challenges investors to focus on the well-being of entrepreneurs by remembering to ask them how they are doing. This theme of responsible investing and good governance has suddenly reached new heights in the wake of the corona crisis.

The crisis situation requires new innovations that startups have the ability and agility to develop. Many of FiBAN’s members want to be involved in solving major problems and they emphasize impact investing in their investment decisions.

Niklas Geust, who recently received the Business Angel of the Year exit 2019 award together with Leena Niemistö, estimates that the dimension of impact investing is becoming one of the cornerstones of investing: “Traditionally, investing is only thought of in relation to returns and risk. I believe that in the future, impact investing will become the third major dimension of startup investing”.

One of the leading business angel networks in the world has developed in Finland during 10 years

The Finnish startup environment and angel investing have developed rapidly over the past ten years. FiBAN, founded in Finland at the end of 2010, will celebrate its tenth anniversary in December 2020. To date, FiBAN members have invested at least 300 million euros in 2,500 startup companies during 2010-2019.

“It is often wondered how Finland, a country with a bit more than five million inhabitants, can have one of the largest and most active business angel networks in the world,” says Amel Gaily. “Since the beginning, Finnish business angels have been working together for the common good and the activity of our members has been the basis of our operations. With openness and collaboration we have come a long way,” she continues.

Close cooperation and co-investments are also done with a wider network of investors, such as vc funds. Experienced FiBAN members have also shifted from angel investing to venture capital, such as Riku Asikainen and Ari Korhonen – both former FiBAN chairs and current honorary members.

In the future, FiBAN wants to collaborate more with other investors, such as industrial players. “For industrial investors, cooperation with business angels opens up a channel for high-quality startups, which have already developed in great strides with the help of experienced investors,” says Linnanvirta. “From a business angel perspective, industrial investors can act as potential customers, partners or buyers of business angel portfolio companies,” he adds.

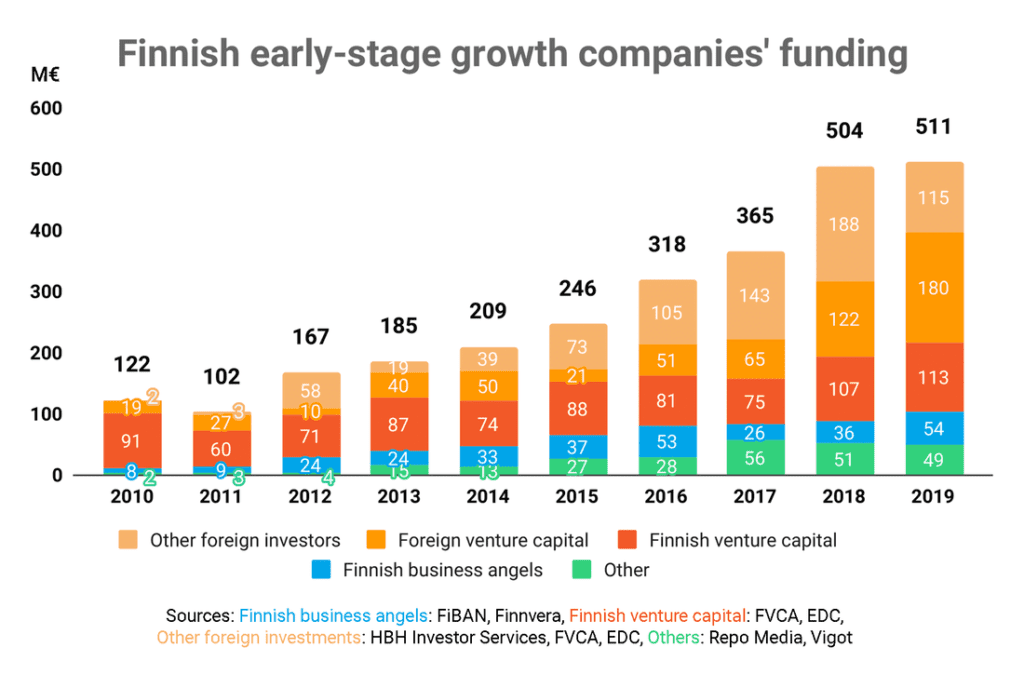

Startups and growth companies in Finland attracted a total of 511 million euros in investments in 2019

FiBAN and Finnish Venture Capital Association (FVCA) publish the investment statistics on the Finnish startup and early-stage growth company funding every spring. The statistics, compiled together, help outline the early stage funding landscape in Finland.

“Research on angel investing is a very interesting theme, and by combining FiBAN’s statistics with broader data sets, we can gather a comprehensive picture of investments in different phases of startups and growth companies. By developing the growth environment for startups in the right direction, we can ensure that Finland remains competitive,” Gaily adds.

According to investment statistics published by FiBAN and FVCA, startups and growth companies raised a new record amount, totaling 511 million euros in 2019. Business angels invested a record amount of 54 million euros and Finnish venture capital funds invested 113 million euros. Foreign investors invested 295 million euros into Finland, of which foreign VC investors accounted for 180 million euros and other foreign investments for 115 million euros. The amount of crowdfunding and other investments was 49 million euros in 2019.

Read more from the FiBAN and FVCA joint press release: Finnish Startup Funding reached new high in 2019

Text: Heidi Tawast, Community Manager, FiBAN

Photos: Wasim Al-Nasser, Communications Assistant, FiBAN